Bursting with potential, your ABA practice thrives on transforming lives, but a hidden financial complex lurks beneath the surface. Claims denied coding complexities; patient payments can leave you lost and stressed. Fear not, fellow navigators! This guide is your compass, unlocking the secrets of efficient ABA revenue cycle management and equipping you with KPIs as guiding lights. From pre-service eligibility to post-payment analysis, we’ll chart a course for optimized revenue and sustainable growth. So, grab your metaphorical map and compass – it’s time to transform your practice from financially fragile to financially fearless!

The ABA RCM Maze: Demystifying Each Stage

RCM is like an intricate maze possessing a potential hurdle toward financial success. Let’s unveil the secrets of each stage, equipping an ABA practitioner with the knowledge to conquer this financial maze.

Stage 1: Pre-Service Preparation

Conducting thorough groundwork before the first therapy is essential. Verifying details like eligibility, insurance coverage, and pre-authorizations acts like a barrier. This stage lays the foundation for clean claims and a faster path to reimbursement.

Stage 2: Capturing the Details of Care

As therapy unfolds, meticulous documentation becomes the treasure map. Detailed notes, accurate data capture, and precise coding ensure a clear picture of the services provided. Think of it as building a bridge between the therapy room and the insurance company, ensuring every step taken is documented and valued.

Stage 3: Billing the Gatekeepers of Gold

Once the therapy is completed comes the time for reimbursement. Timely claim submission and ensuring adherence to payer rules and coding compliance are an important step for a successful claim settlement. Every detail matters, from patient demographics to diagnosis codes, paving the way for swift claim processing and golden reimbursements.

Stage 4: Navigating the Denials and Delays

Even the most skilled navigators can encounter detours. Denials and delays do not mean dead ends. Identifying the root cause of denials, like missing information or coding errors, helps you to appeal effectively. Proactive insurance follow-up ensures claims don’t get lost among others claims.

Stage 5: Measuring the Rewards and Refining the Path

Once the claims get settled, post-payment analysis, like tracking revenue per client and return on investment, reveals the fruits of your RCM journey. Metrics like insightful compass readings, guide you toward continuous improvement. It is now time to optimize workflows, refine strategies, and celebrate successes.

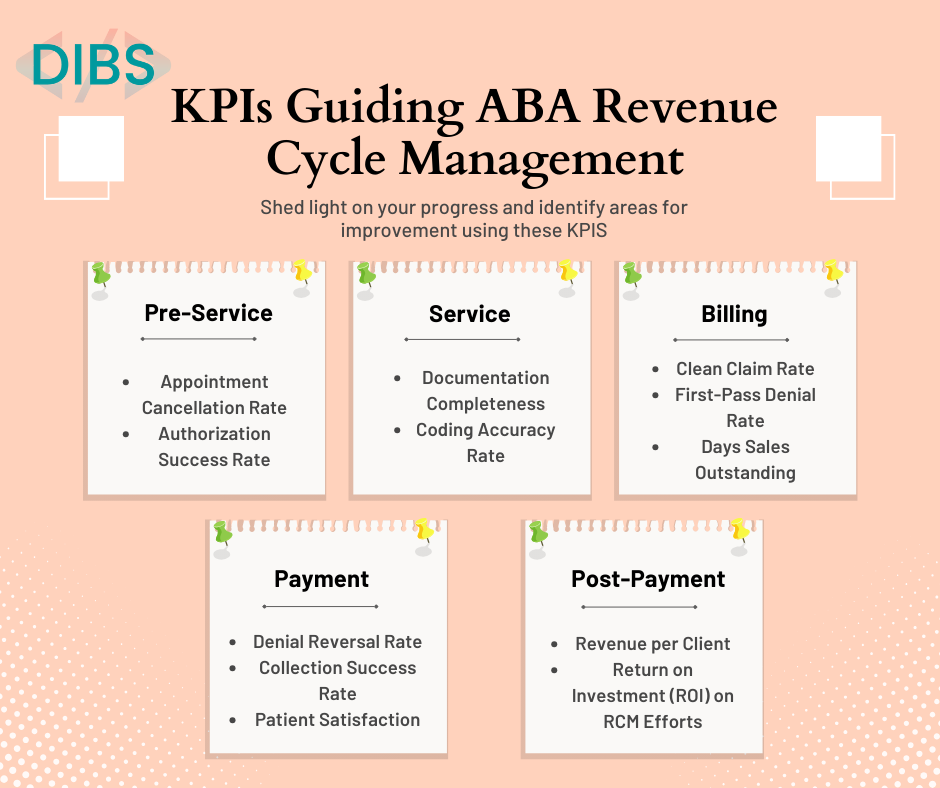

Demystifying ABA KPIs: Your Guiding Lights in the Revenue Cycle Management Maze

Key performance indicators (KPIs) act as beacons in the ABA RCM journey. These measurable metrics shed light on your progress and identify areas for improvement, ensuring smooth financial operation. Let’s delve into each stage of the RCM journey and explore the KPIs that guide your way.

Pre-Service: Setting the Course with Precision

- Appointment Cancellation Rate: Tracks missed appointments, highlighting potential scheduling issues or insurance hurdles.

- Authorization Success Rate: Measures the efficiency of securing pre-approvals, indicating potential gaps in eligibility verification or coding education.

Service: Charting the Course with Accuracy

- Documentation Completeness: Ensures all necessary information is captured, minimizing claim denials due to missing details.

- Coding Accuracy Rate: Measures the adherence to correct codes, preventing claim rejections and delays.

Billing: Reaching the Treasure Island of Reimbursement

- Clean Claim Rate: Tracks the percentage of claims submitted error-free, speeding up processing and maximizing revenue.

- First-Pass Denial Rate: Identifies areas where claims are initially rejected, guiding targeted improvement efforts.

- Days Sales Outstanding (DSO): Measures the average time it takes to receive payments, revealing potential delays in billing or collections.

Payment: Securing the Golden Treasure

- Denial Reversal Rate: Tracks the success rate of appealing denied claims, showcasing your effectiveness in resolving billing discrepancies.

- Collection Success Rate: Measures the efficiency of collecting patient payments, ensuring financial stability.

- Patient Satisfaction: Indicates how effectively the RCM processes are working for patients.

Post-Payment: Refining the Map for Future Journeys

- Revenue per Client: Analyzes the financial return on each client engagement, guiding pricing and service delivery strategies.

- Return on Investment (ROI) on RCM Efforts: Assesses the cost-effectiveness of your RCM processes, helping you identify areas for optimization.

Conquering the Maze: Strategies for RCM Success

Even with a map and guiding lights, navigating the ABA RCM network can feel daunting. Here are potent strategies to equip you for efficient RCM and financial victory.

Technology Your Trusted Ally:

Embrace technology as your loyal companion. Automated scheduling systems minimize cancellations, pre-authorization software streamlines insurance approvals, and electronic billing platforms ensure accuracy and speed. Invest in tools that lighten your load and illuminate the path to smooth sailing.

Knowledge is Power, Train Your Crew:

Equip your team with the knowledge to decode the RCM mysteries. Invest in training programs on coding compliance, documentation best practices, and claim submission procedures. Sharpen your crew’s skills and boost financial success.

Monitor the KPIs and optimize the workflow:

Regularly monitor your KPIs to streamline your Revenue Cycle Management. Analyze denial trends, track turnaround times, and assess collection rates. Use these insights to adjust your operations, streamline workflows, and refine strategies for optimal performance.

Seek Expert Guidance:

Sometimes, even the most skilled navigators benefit from a seasoned guide. Partnering with experienced RCM service providers offers invaluable expertise and support. They can analyze your RCM processes, identify hidden pitfalls, and recommend effective strategies to streamline your financial journey.

Set a Benchmark for Progress:

Compare your RCM performance with industry benchmarks and best practices. Analyze metrics like clean claim rates, denial turnaround times, and collection success rates. Use these insights to set aspirational goals and push yourself further, becoming the gold standard in ABA RCM excellence.

Conclusion

Financial stability is not a myth, but a journey led by knowledge, technology, and strategic planning. Embrace the power of KPIs, equip your team, and chart a course guided by industry benchmarks. With each hurdle cleared and every successful claim, your ABA practice journey comes closer to financial freedom.

Talk to our experts to learn more about successful ABA Revenue Cycle Management and KPIs strategies. Learn how the DIBS team can help you build a successful RCM software customized to monitor KPIs according to your needs.

Leave a Comment